Studies show that 70% of Americans don’t know that there are down payment and closing cost programs available in every community. The Colorado REALTOR® Down Payment Program is a free tool that helps you discover down payment programs that fit your personal situation. Check it out at www.coloradorealtors.com/down-payment-program/

Tag Archives: sales

Pending home sales in March continued to Rise

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, climbed 1.1 percent to 108.6 in March from an upward revision of 107.4 in February and is now 11.1 percent above March 2014 (97.7). The index has now increased year-over-year for seven consecutive months and is at its highest level since June 2013 (109.4).

Lawrence Yun, NAR chief economist, says contract signings picked up in March as more buyers than usual entered this year’s competitive spring market. “Demand appears to be stronger in several parts of the country, especially in metro areas that have seen solid job gains and firmer economic growth over the past year,” he said. “While contract activity being up convincingly compared to a year ago is certainly good news, the increased number of traditional buyers who appear to be replacing investors paying in cash is even better news1. It indicates this year’s activity is being driven by more long-term homeowners.”

Read more at: http://ow.ly/MhZfD

Filed under NAR

Pending Home Sales in February Up

Pending home sales in February increased to their highest level since June 2013 as sizeable gains in the Midwest and West offset smaller declines in the Northeast and South, according to the National Association of Realtors®.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.1 percent to 106.9 in February from a slight downward revision of 103.7 in January and is now 12.0 percent above February 2014 (95.4). The index is at its highest level since June 2013 (109.4), has increased year-over-year for six consecutive months and is above 100 – considered an average level of activity – for the 10th consecutive month.

Lawrence Yun, NAR chief economist, says demand appears to be strengthening as we head into the spring buying season. “Pending sales showed solid gains last month, driven by a steadily-improving labor market, mortgage rates hovering around 4 percent and the likelihood of more renters looking to hedge against increasing rents,” he said. “These factors bode well for the prospect of an uptick in sales in coming months. However, the underlying obstacle – especially for first-time buyers – continues to be the depressed level of homes available for sale.”

According to NAR’s monthly Realtors® Confidence Index, the percent share of first-time buyers increased slightly for the first time in February since November 2014, up to 29 percent from 28 percent in January.

“Several markets remain highly-competitive due to supply pressures, and Realtors® are reporting severe shortages of move-in ready and available properties in lower price ranges,” adds Yun. “The return of first-time buyers this year will depend on how quickly inventory shows up in the market.”

The PHSI in the Northeast fell 2.3 percent to 81.7 in February, but is 4.1 percent above a year ago. In the Midwest the index leaped 11.6 percent to 110.4 in February, and is now 13.8 percent above February 2014.

Pending home sales in the South decreased 1.4 percent to an index of 120.2 in February, but is still 10.8 percent above last February. The index in the West climbed 6.6 percent in February to 102.1 (highest since June 2013 at 111.4) and is now 18.3 percent above a year ago.

Total existing-homes sales in 2015 are forecast to be around 5.25 million, an increase of 6.4 percent from 2014. The national median existing-home price for all of this year is expected to increase around 5.6 percent. In 2014, existing-home sales declined 2.9 percent and prices rose 5.7 percent.

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

Filed under NAR

Pending Home Sales Rise in January to Highest Level in 18 Months

WASHINGTON (February 27, 2015) — Improved buyer demand at the beginning of 2015 pushed pending home sales in January to their highest level since August 2013, according to the National Association of Realtors®. All major regions except for the Midwest saw gains in activity in January.

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, climbed 1.7 percent to 104.2 in January from an upwardly revised 102.5 in December and is now 8.4 percent above January 2014 (96.1). This marks the fifth consecutive month of year-over-year gains with each month accelerating the previous month’s gain.

Lawrence Yun, NAR chief economist, says for the most part buyers in January were able to overcome tight supply to sign contracts at a pace that highlights the underlying demand that exists in today’s market. “Contract activity is convincingly up compared to a year ago despite comparable inventory levels,” he said. “The difference this year is the positive factors supporting stronger sales, such as slightly improving credit conditions, more jobs and slower price growth.”

Yun also points to more favorable conditions for traditional buyers entering the market. All-cash sales and sales to investors are both down from a year ago1, creating less competition and some relief for buyers who still face the challenge of limited homes available for sale.

“All indications point to modest sales gains as we head into the spring buying season,” says Yun. “However, the pace will greatly depend on how much upward pressure the impact of low inventory will have on home prices. Appreciation anywhere near double-digits isn’t healthy or sustainable in the current economic environment.”

The PHSI in the Northeast inched 0.1 percent to 84.9 in January, and is now 6.9 percent above a year ago. In the Midwest the index decreased 0.7 percent to 99.3 in January, but is 4.2 percent above January 2014.

Pending home sales experienced the largest increase in the South, up 3.2 percent to an index of 121.9 in January (highest since April 2010) and are 9.7 percent above last January. The index in the West rose 2.2 percent in January to 96.4 and is 11.4 percent above a year ago.

Total existing-homes sales in 2015 are forecast to be around 5.26 million, an increase of 6.4 percent from 2014. The national median existing-home price for all of this year is expected to increase near 5 percent. In 2014, existing-home sales declined 2.9 percent and prices rose 5.7 percent.

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

More at: http://ow.ly/JVD86

Filed under NAR

Existing-Home Sales Declined in January

WASHINGTON (February 23, 2015) – Existing-home sales declined in January to their lowest rate in nine months, but the pace was higher than a year ago for the fourth straight month, according to the National Association of Realtors®. All major regions experienced declines in January, with the Northeast and West seeing the largest.

Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 4.9 percent to a seasonally adjusted annual rate of 4.82 million in January (lowest since last April at 4.75 million) from an upwardly-revised 5.07 million in December. Despite January’s decline, sales are higher by 3.2 percent than a year ago.

Existing-home sales in the West dropped 7.1 percent to an annual rate of 1.04 million in January, but are still 1.0 percent above a year ago. The median price in the West was $291,800, which is 7.2 percent above January 2014.NOTE: For local information, please contact the local association of Realtors® for data from local multiple listing services. Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

Filed under Marketings/Sales, NAR

FHA: Lower Premiums Will Not Cost Taxpayers

The Federal Housing Administration’s new lower annual premiums on insurance for home buyers will not come at the cost of another taxpayer bailout, Julian Castro, the secretary of the Housing and Urban Development, told CNBC Monday. HUD regulates FHA, which insures home loans with down payments as low as 3.5 percent.

On Monday, the FHA lowered its annual premiums on the loans it insures from 1.35 percent to 0.85 percent. The move is expected to save a typical first-time home buyer about $900 a year.

During the housing crisis, the FHA had raised its annual premiums 140 percent. The rise in premium prices was blamed for sidelining thousands of potential home shoppers. FHA rose its premiums to replenish its capital reserves, which were depleted during the housing crisis due to a high number of defaults.

Last year, FHA regained its financial footing and was back in the black with its financing. But in 2013, the agency did require a $1.7 billion taxpayer bailout.

Lowering the insurance premiums for buyers “is a very prudent step in the direction of providing middle-class families with opportunities for buying a home,” Castro told CNBC. “We’re not changing who qualifies for an FHA loan. What we’re talking about here is affordability.”

FHA’s insurance fund gained about $21 billion in the past few years, mostly attributed to its new borrowers who had stellar credit. If the FHA had not lowered its insurance premiums, the agency stood to lose considerable market share – and jeopardize funding again to the FHA fund. In a move to open its credit box, Freddie Mac and Fannie Mae recently announced that first-time buyers can qualify for loans with down payments as low as 3 percent.

Source: “HUD Boss on FHA Loans: ‘We’re Not Changing Who Qualifies,’” CNBC (Jan. 26, 2015)

Filed under Morgtage News, Uncategorized

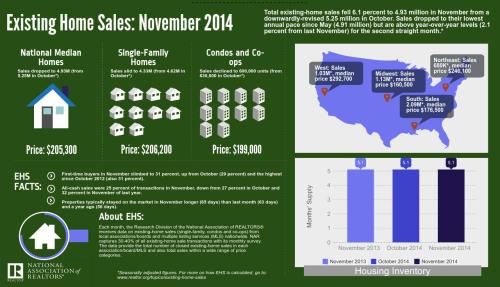

Home Sales Slow in November

After hitting their highest level of the year, existing-home sales slid in November as housing supply showed some tightening, according to the National Association of Realtors®. All major regions experienced a decline in sales compared to a month earlier.

After hitting their highest level of the year, existing-home sales slid in November as housing supply showed some tightening, according to the National Association of Realtors®. All major regions experienced a decline in sales compared to a month earlier.

Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 6.1 percent to a seasonally adjusted annual rate of 4.93 million in November from a downwardly-revised 5.25 million in October. Sales dropped to their lowest annual pace since May (4.91 million) but are above year-over-year levels (up 2.1 percent from last November) for the second straight month.

Lawrence Yun, NAR chief economist, says sales activity was choppy throughout the country in November and housing inventory began its seasonal decline. “Fewer people bought homes last month despite interest rates being at their lowest levels of the year,” he said. “The stock market swings in October may have impacted some consumers’ psyches and therefore led to fewer November closings. Furthermore, rising home values are causing more investors to retreat from the market.”

The median existing-home price2 for all housing types in November was $205,300, which is 5.0 percent above November 2013. This marks the 33rd consecutive month of year-over-year price gains.

Total housing inventory3 at the end of November fell 6.7 percent to 2.09 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace – unchanged from last month. Despite the tightening in supply, unsold inventory remains 2.0 percent higher than a year ago, when there were 2.05 million existing homes available for sale.

“Lagging homebuilding activity continues to hamstring overall housing supply and is still too low in relation to this year’s promising job growth,” says Yun. “Much faster price and rent appreciation – easily exceeding wage growth – will occur next year unless new construction picks up measurably.”

All-cash sales were 25 percent of transactions in November, down from 27 percent in October and 32 percent in November of last year.

Individual investors, who account for many cash sales, purchased 15 percent of homes in November, unchanged from last month and below November 2013 (19 percent). Sixty-one percent of investors paid cash in November.

The percent share of first-time buyers in November climbed to 31 percent, up from October (29 percent) and is the highest share since October 2012 (also 31 percent). First-time buyers have represented an average of 29 percent of buyers through November of this year.

NAR President Chris Polychron, executive broker with 1st Choice Realty in Hot Springs, Ark., says Fannie Mae and Freddie Mac’s new low downpayment program should improve access to credit for responsible buyers. “NAR applauds Fannie and Freddie’s commitment to homeownership by serving creditworthy borrowers who lack the resources for substantial downpayments plus closing costs with its new downpayment program,” he said. “The new program mitigates risk with strong underwriting and ensures that responsible buyers have access to safe and affordable mortgage credit. Furthermore, NAR believes lenders must do their part to ensure loans are prudently underwritten and are made available to qualified borrowers.”

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage in November dropped to 4.00 percent, its lowest level since May 2013 (3.54 percent), and down from 4.04 percent in October.

Distressed sales4 – foreclosures and short sales – were unchanged in November from October (9 percent) and remained in the single digits for the fourth month this year; they were 14 percent a year ago. Six percent of November sales were foreclosures and 3 percent were short sales. Foreclosures sold for an average discount of 17 percent below market value in November (15 percent in October), while short sales were discounted 13 percent (10 percent in October).

Properties typically stayed on the market in November longer (65 days) than last month (63 days) and a year ago (56 days). Short sales were on the market the longest at a median of 116 days in November, while foreclosures sold in 65 days and non-distressed homes took 63 days. Thirty-two percent of homes sold in November were on the market for less than a month.

Single-family and Condo/Co-op Sales

Single-family home sales dropped 6.3 percent to a seasonally adjusted annual rate of 4.33 million in November from 4.62 million in October, but remain 2.4 percent above the 4.23 million pace a year ago. The median existing single-family home price was $206,200 in November, up 5.6 percent from November 2013.

Existing condominium and co-op sales declined 4.8 percent to a seasonally adjusted annual rate of 600,000 units in November from 630,000 in October, and are unchanged from a year ago. The median existing condo price was $199,000 in November, which is 1.2 percent higher than a year ago.

West Breakdown

Existing-home sales in the West dropped 9.6 percent to an annual rate of 1.03 million in November, and remain 1.0 percent below a year ago. The median price in the West was $292,700, which is 3.5 percent above November 2013.

Filed under Marketings/Sales, NAR

Apartment Rent Surge Expected into 2015

Renters need to brace themselves: Apartment rent is expected to continue to outpace inflation next year. It’s a landlord’s market, which means strong demand continues to give landlords justification to hike rents.

Rent growth will likely reach 3.9 percent in 2015, only a slight dip from 4 percent this year, according to a recent forecast released by the National Association of REALTORS®. For at least two more years, vacancy rates for rental apartments are expected to remain low.

“Low housing inventory and the sizable demand for rentals will continue to spur multifamily construction as well as keep rents rising above inflation through next year,” says Lawrence Yun, NAR’s chief economist.

The Bureau of Labor Statistics shows that annual rental inflation is nearly double the price of overall inflation.

Builders are increasing the construction of multifamily units but are struggling to keep pace with demand.

Filed under Marketings/Sales

Spruce Up Your Fireplace

Many homebuyers would pay more for a house with a fireplace — as much as $1,400. Here are great ways to enhance your fireplace gestalt.

Read more and see photos at: http://ow.ly/Ca2rC

Filed under Real Estate Trends

Pending Home Sales Pick Up in July

he Pending Home Sales Index,* a forward-looking indicator based on contract signings, climbed 3.3 percent to 105.9 in July from 102.5 in June, but is still 2.1 percent below July 2013 (108.2). The index is at its highest level since August 2013 (107.1) and is above 100 – considered an average level of contract activity – for the third consecutive month.

Lawrence Yun, NAR chief economist, says favorable housing conditions are behind July’s higher contract activity. “Interest rates are lower than they were a year ago, price growth continues to moderate and total housing inventory is at its highest level since August 20121,” he said. “The increase in the number of new and existing homes for sale is creating less competition and is giving prospective buyers more time to review their options before submitting an offer.”

Yun adds, “More importantly, steady job additions to the economy are helping family finances and giving them added confidence to enter the market.”

The PHSI in the Northeast jumped 6.2 percent to 89.2 in July, and is 8.3 percent above a year ago. In the Midwest the index marginally fell 0.4 percent to 104.6 in July, and is 6.4 percent below July 2013.

Pending home sales in the South increased 4.2 percent to an index of 119.0 in July, and is now 1.0 percent below a year ago. The index in the West rose 4.0 percent in July to 99.5, but remains 6.0 percent below July 2013.

Yun expects existing-homes sales to be down 2.1 percent this year to 4.98 million, compared to 5.09 million sales of existing homes in 2013. The national median existing-home price is projected to grow between 5 and 6 percent this year and 4 and 5 percent next year.

Filed under NAR, Real Estate Trends